Electric vehicle tax credits, rebates and other incentives

Federal Credit

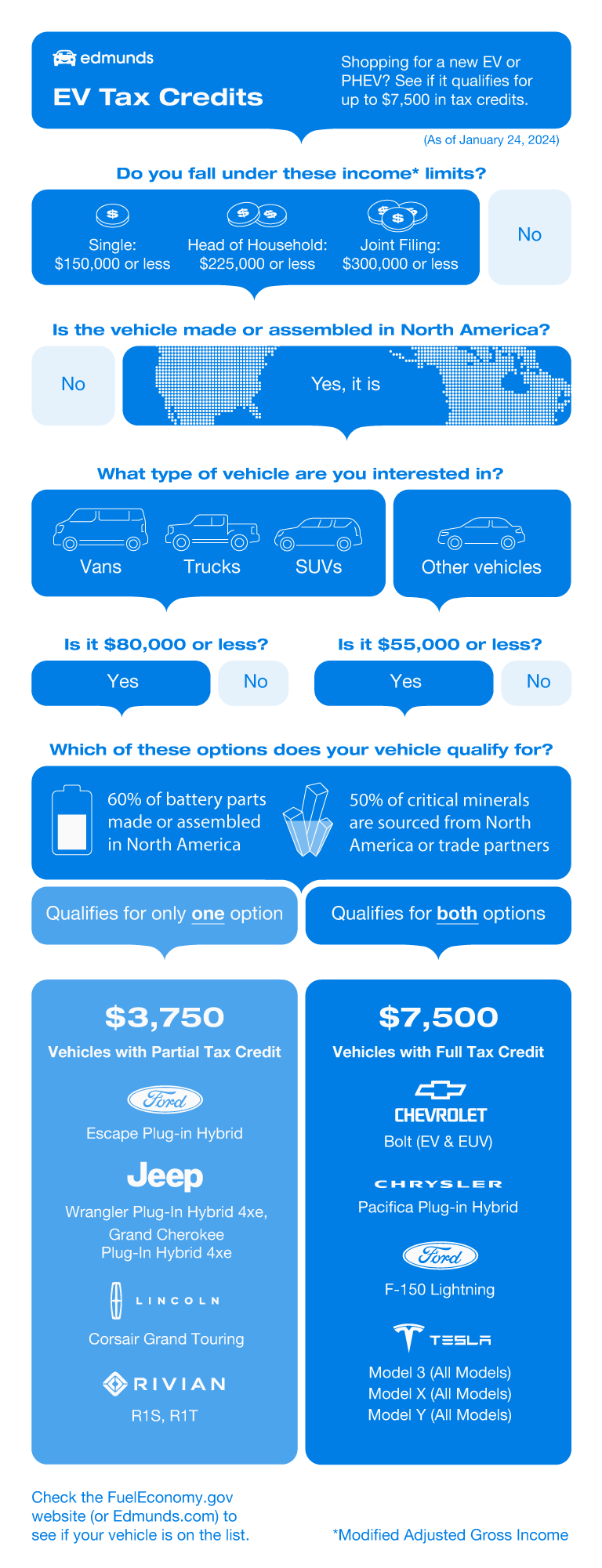

$7,500Maximum RebateUnder the Inflation Reduction Act of 2022, the Internal Revenue Service (IRS) offers taxpayers a Clean Vehicle Tax Credit of $3,750 or $7,500 depending on model eligibility for the purchase of a new plug-in electric vehicle. Beginning January 1, 2024, Clean Vehicle Tax Credits may be initiated and approved at the point of sale at participating dealerships registered with the IRS. Dealers will be responsible for submitting Clean Vehicle Tax Credit information to the IRS. Buyers are advised to obtain a copy of an IRS "time of sale" report, confirming it was submitted successfully by the dealer. To be eligible:

- A vehicle must have undergone final assembly in North America (the United States and Puerto Rico, Canada, or Mexico).

- Critical mineral and battery component requirements determine credit amount.

- Maximum MSRP of $55,000 for cars and $80,000 for SUVs/trucks/vans.

- Income eligibility applies depending on modified adjusted gross income (AGI) and tax filing status.

To learn more, visit https://www.irs.gov/credits-deductions/credits-for-new-clean-vehicles-purchased-in-2023-or-after

In Stock Inventory Offer

$5,500Maximum Rebate2024 Mach-E/Lightning VIN Specific Bonus Cash (#32578). Eligible buyers may receive 2024 Mach-E/Lightning VIN Specific Bonus Cash on select new vehicles. Incentive may be incompatible with certain finance types or other cash programs, based on individual program rules. Take new retail delivery from dealer stock by 07/07/2025. Residency restrictions apply. See dealer for qualifications and complete details.Customer Bonus Cash

$2,500Maximum RebateRetail Bonus Cash (#11442). Eligible buyers may receive Retail Bonus Cash on select new vehicles. Incentive may be incompatible with certain finance types or other cash programs, based on individual program rules. Take new retail delivery from dealer stock by 06/02/2025. Residency restrictions apply. See dealer for qualifications and complete details.Affiliations, Clubs or Groups Offer

$2,000Maximum RebateFor a limited time, eligible Costco members can get an incentive on select new Audi models.* *To qualify for the Audi Limited-Time Special, you must: (1) be a current Costco member by March 3, 2025; (2) register with Costco Auto Program online or through its call center to receive a certificate with your unique promotion code by April 30, 2025; (3) present your certificate and unique promotion code to a participating Audi dealer at the time of visit; (4) purchase or lease a select, new and unused 2024 or 2025 Audi between March 4, 2025, and April 30, 2025, to receive a Costco member-only incentive: $1,000 towards Audi A3, S3, Q3, Q4 e-tron, Q4 Sportback e-tron, or $2,000 towards Audi A5 Sportback, S5 Sportback, A6 Sedan, A6 Allroad, S6, A7 sedan, S7, A8, S8, Q5, Q5 Sportback, SQ5, SQ5 Sportback, Q6 e-tron, SQ6 e-tron, Q7, SQ7, Q8, SQ8, Q8 e-tron, Q8 Sportback e-tron, SQ8 e-tron, SQ8 Sportback e-tron, e-tron GT, S e-tron GT, RS e-tron GT. Incentive will be applied toward eligible purchase or lease and is compatible with current manufacturer incentives for which you qualify. May not be combined with Dealer Employee Purchase Program, VIP & Diplomat Sales Program, or any Corporate Sales Program. Incentive not redeemable for cash. This Limited-Time Special excludes Audi A5 Coupe, S5 Coupe, A5 Cabriolet, S5 Cabriolet, R models, RS models (except RS e-tron GT). Promotion codes are not transferable. Valid only to whom the unique offer is addressed or members of the same household. Vehicles sold in the name of a business will be verified against the primary purchaser's driver's license to ensure eligibility. Only one promotion code per VIN will be accepted. Visit CostcoAuto.com/Audi for full details. Costco and its affiliates do not sell automobiles or negotiate individual transactions.Adaptive Equipment Allowance

$1,500Maximum RebateAudi is pleased to announce that we are continuing the Mobility Assistance Program for handicap hand controls that are installed on any qualifying Audi model. We will also consider other types of handicap assists (or other approved handicap assistance devices.) to anyone who purchases or leases a new Audi or CPO Audi vehicle. All exception requests from dealers should be made directly to mobilityassistance@audi.comAffiliations, Clubs or Groups Offer

$1,500Maximum RebateUAW Member Offer (#32310). Eligible buyers may receive a UAW Member Offer on select new vehicles. Incentive may be incompatible with certain finance types or other cash programs, based on individual program rules. Not all buyers will qualify. Take new retail delivery from dealer stock by 07/07/2025. Residency restrictions apply. See dealer for qualifications and complete details.Adaptive Equipment Allowance

$1,000Maximum RebateThe FCA US Driveability / Automobility Program offers eligible physically challenged (physically disabled) U.S. retail consumers a cash allowance applied to the retail purchase (Type 1 sale), Lease (Type Sale L), or business (Type B or Type E) or 2nd Stage Manufacturer (Type Sale 8) of adaptive driving or passenger equipment installed on a new eligible vehicle. Authorized FCA US LLC dealerships are eligible to apply the cash reimbursement on lowered floor conversions only (a maximum of up to $1,000) to the complete purchase or lease of an eligible adapted vehicle transaction; qualifying the dealer for direct cash allowance reimbursement under this program. Refer to the Authorized Dealer Section of the rules for further definitions, eligibilities and details. Restrictions apply.Adaptive Equipment Allowance

$1,000Maximum RebateThe FCA US Driveability / Automobility Program offers eligible physically challenged (physically disabled) U.S. retail consumers a cash allowance applied to the retail purchase (Type 1 sale), Lease (Type Sale L), or business (Type B or Type E) or 2nd Stage Manufacturer (Type Sale 8) of adaptive driving or passenger equipment installed on a new eligible vehicle. Authorized FCA US LLC dealerships are eligible to apply the cash reimbursement on lowered floor conversions only (a maximum of up to $1,000) to the complete purchase or lease of an eligible adapted vehicle transaction; qualifying the dealer for direct cash allowance reimbursement under this program. Refer to the Authorized Dealer Section of the rules for further definitions, eligibilities and details. Restrictions apply.Affiliations, Clubs or Groups Offer

$1,000Maximum RebateAmerican Medical Association Members, American Dental Association Members, American Bar Association Members with eligible PIN may be eligible for incentive. See your Volvo retailer for complete details.First Responder Offer

$1,000Maximum RebateOffer available to Police Officers, Sheriffs/Sheriff's Deputies, Correctional Officers, State Troopers, Federal Law Enforcement Officers, Career Firefighters, Volunteer Firefighters, EMTs and Paramedics. Spouses of deceased Police Officers, Firemen and EMTs who died in the line of duty are also eligible. Eligible customers must be in possession of a valid First Responders Validation ID and must show proof with qualifying documentation. Contact dealer for details. Must take delivery by 06/30/2025. (47CSA9)Student or College Grad Offer

$750Maximum Rebate2025 College Student Recognition Exclusive Cash Reward Pgm. (#32520). Eligible buyers may receive a 2025 College Student Recognition Exclusive Cash Reward Pgm. on select new vehicles. Incentive may be incompatible with certain finance types or other cash programs, based on individual program rules. Not all buyers will qualify. Take new retail delivery from dealer stock by 01/05/2026. Residency restrictions apply. See dealer for qualifications and complete details.Complimentary Charging Offer

$500Maximum RebateOffer cannot be combined with complimentary home charger installation offer. EV Public Charging Credit #11436. Ford is offering a $500 Public Charging Credit to customers who purchase or lease a 2022-2025 Mach-E, F-150 Lightning, Transit ElectricFirst Responder Offer

$500Maximum Rebate2025 First Responder Recognition Exclusive Cash Reward (#32522). Eligible buyers may receive a 2025 First Responder Recognition Exclusive Cash Reward on select new vehicles. Incentive may be incompatible with certain finance types or other cash programs, based on individual program rules. Not all buyers will qualify. Take new retail delivery from dealer stock by 01/05/2026. Residency restrictions apply. See dealer for qualifications and complete details.First Responder Offer

$500Maximum RebateGeneral Motors First Responder Cash Allowance Program. Eligible customers which include firefighters, police, EMT/paramedics and 911 dispatch can use this allowance toward the purchase/lease of an eligible model. Proof of employment and authorization code required. See dealer for details or visit www.gmfirstresponderdiscount.com for complete eligibility details.First Responder Offer

$500Maximum RebateGeneral Motors First Responder Cash Allowance Program. Eligible customers which include firefighters, police, EMT/paramedics and 911 dispatch can use this allowance toward the purchase/lease of an eligible model. Proof of employment and authorization code required. See dealer for details or visit www.gmfirstresponderdiscount.com for complete eligibility details.First Responder Offer

$500Maximum RebateGeneral Motors First Responder Cash Allowance Program. Eligible customers which include firefighters, police, EMT/paramedics and 911 dispatch can use this allowance toward the purchase/lease of an eligible model. Proof of employment and authorization code required. See dealer for details or visit www.gmfirstresponderdiscount.com for complete eligibility details.

2024 Chevrolet Blazer EV

$7,500Vehicle Rebates$100Charging Rebates+ more qualifying rebates2025 Tesla Model Y

$7,500Vehicle Rebates$100Charging Rebates2024 Honda Prologue

$7,500Vehicle Rebates$100Charging Rebates2025 Chevrolet Blazer EV

$7,500Vehicle Rebates$100Charging Rebates+ more qualifying rebates2025 Honda Prologue

$7,500Vehicle Rebates$100Charging Rebates2024 Ford F-150 Lightning

$7,500Vehicle Rebates$100Charging Rebates+ more qualifying rebates2025 Tesla Model 3

$7,500Vehicle Rebates$100Charging Rebates2026 Tesla Model Y

$7,500Vehicle Rebates$100Charging Rebates2024 Acura ZDX

$7,500Vehicle Rebates$100Charging Rebates2025 Hyundai IONIQ 5

$7,500Vehicle Rebates$100Charging Rebates2025 Ford F-150 Lightning

$7,500Vehicle Rebates$100Charging Rebates+ more qualifying rebates2024 Chevrolet Equinox EV

$7,500Vehicle Rebates$100Charging Rebates+ more qualifying rebates2025 Jeep Wagoneer S

$7,500Vehicle Rebates$100Charging Rebates+ more qualifying rebates2025 Tesla Cybertruck

$7,500Vehicle Rebates$100Charging Rebates2025 Cadillac OPTIQ

$7,500Vehicle Rebates$100Charging Rebates+ more qualifying rebates

Federal EV Tax Credits Overview

Federal EV Tax Credit Incentive #1: North American Final Assembly

Federal EV Tax Credit Incentive #2: Origin of Critical Battery Minerals ($3,750 Tax Credit)

Federal EV Tax Credit Incentive #3: Origin of Battery Components ($3,750 Tax Credit)

Federal EV Tax Credit Incentive #4: No Involvement by Blacklisted Countries After 2023

Federal EV Tax Credit Incentive #5: Price Limits

Federal EV Tax Credit Incentive #6: Buyer Income Limits

FAQ

EV Tax Credits Vehicle Eligibility

More EV News Articles

- Electric Vehicle Tax Credits: What You Need to KnowRonald Montoya•09/08/2022

- Best Electric Cars of 2022 and 2023Edmunds

- Edmunds' EV Buying GuideEdmunds•05/05/2022

- Cheapest Electric CarsEdmunds•03/22/2022

- The True Cost of Powering an Electric CarEdmunds•03/29/2022

- Home EV Charging 101Jonathan Elfalan•04/21/2021

- The Slate Auto $20,000 Electric Truck Has Huge Potential but Many UnknownsClint Simone•04/25/2025

- 2025 Chevy Blazer EV SS First Drive: The Only EV You'll Ever Need?Cameron Rogers•04/22/2025

- 2026 Kia EV9 Nightfall First Look: Back in BlackJosh Jacquot•04/16/2025

- 2026 Kia EV4 First Look: Funky Futuristic Electric SedanRyan Greger•04/16/2025

- Tesla Model Y vs. Equinox EV vs. Ioniq 5 vs. Prologue: Which Electric SUV Is Best?Brian Wong•04/11/2025